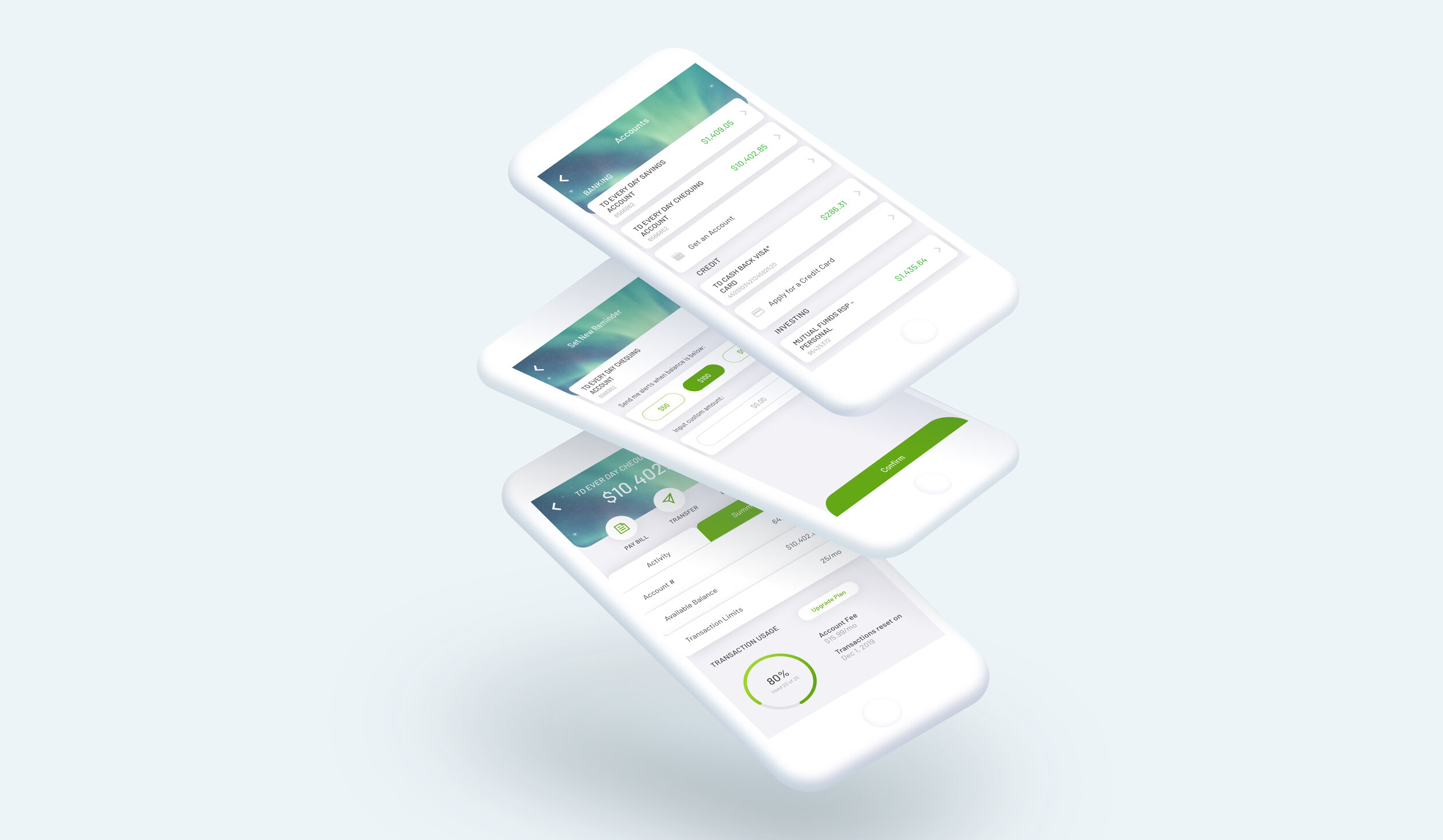

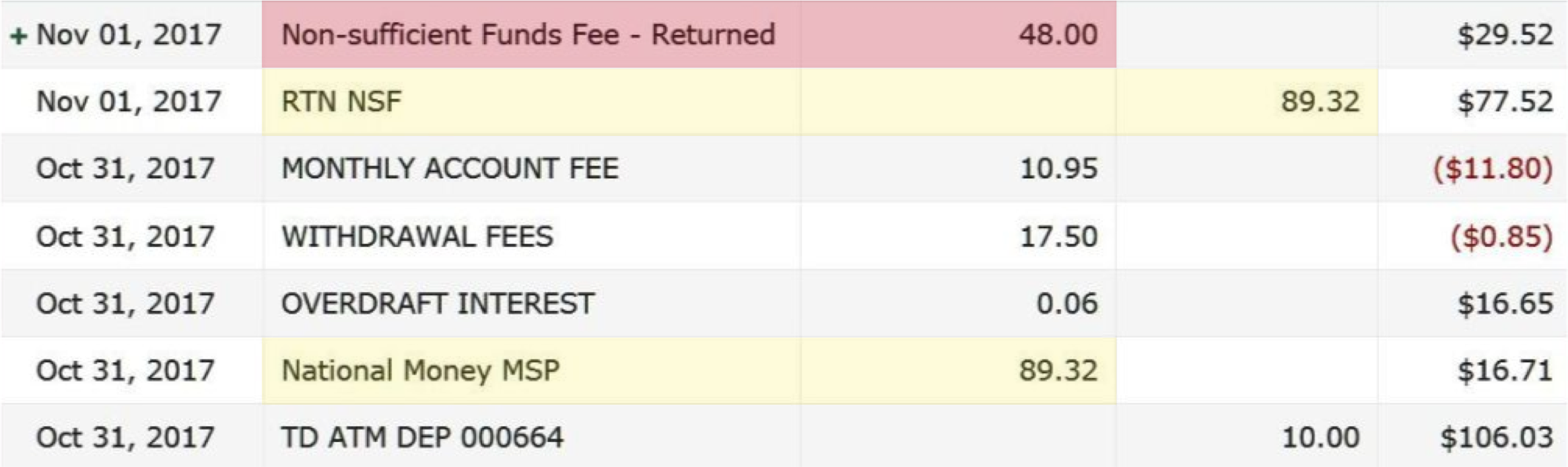

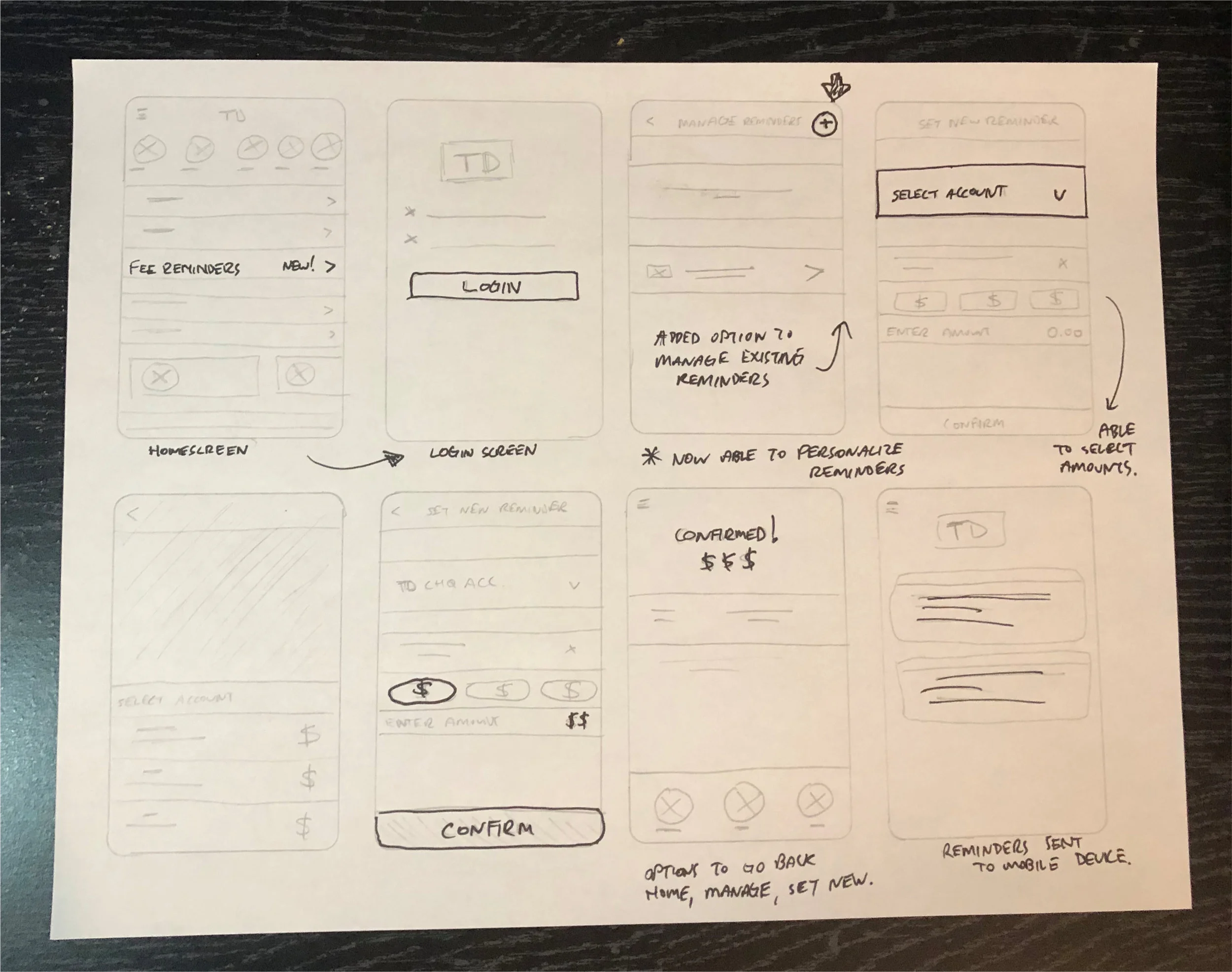

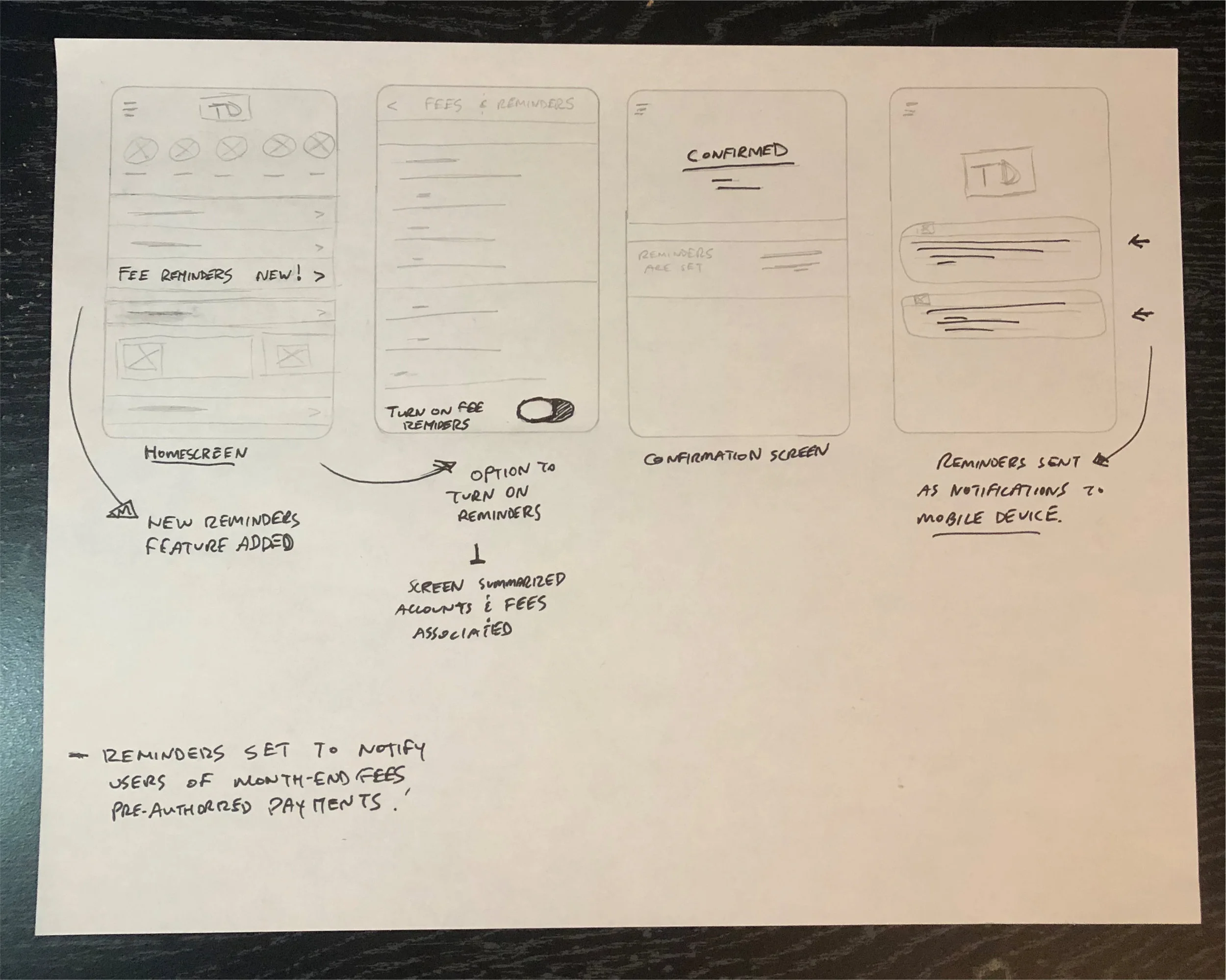

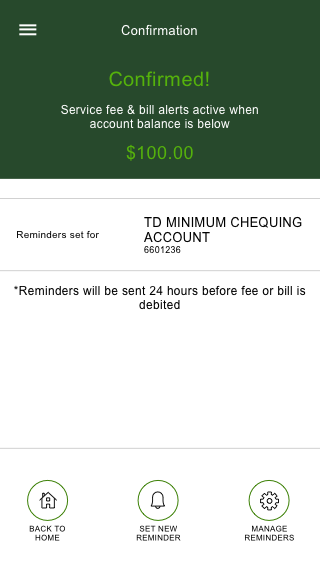

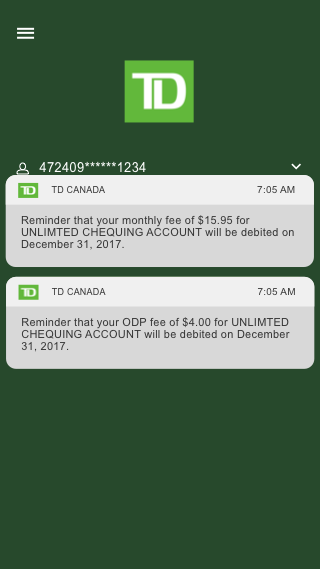

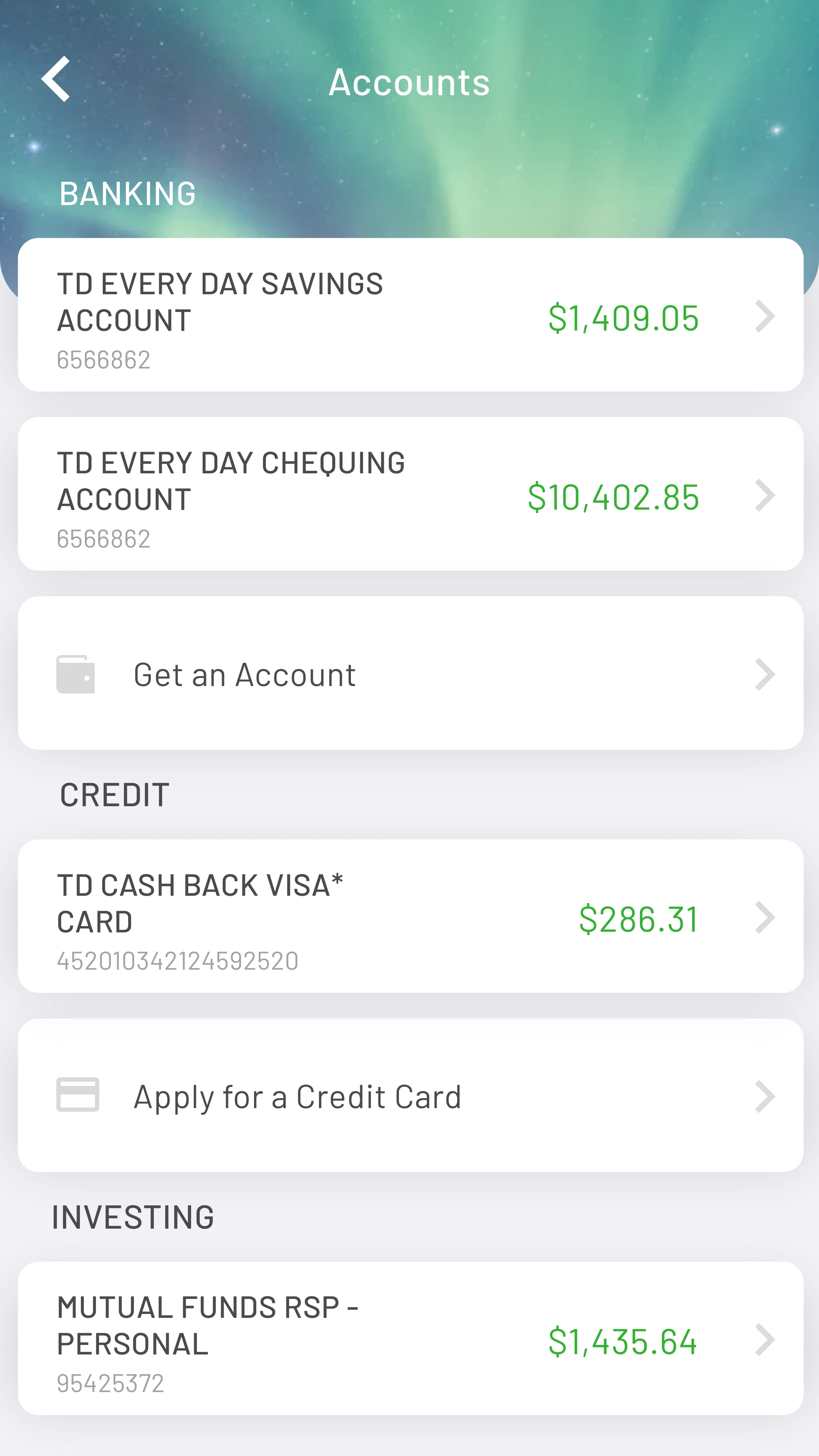

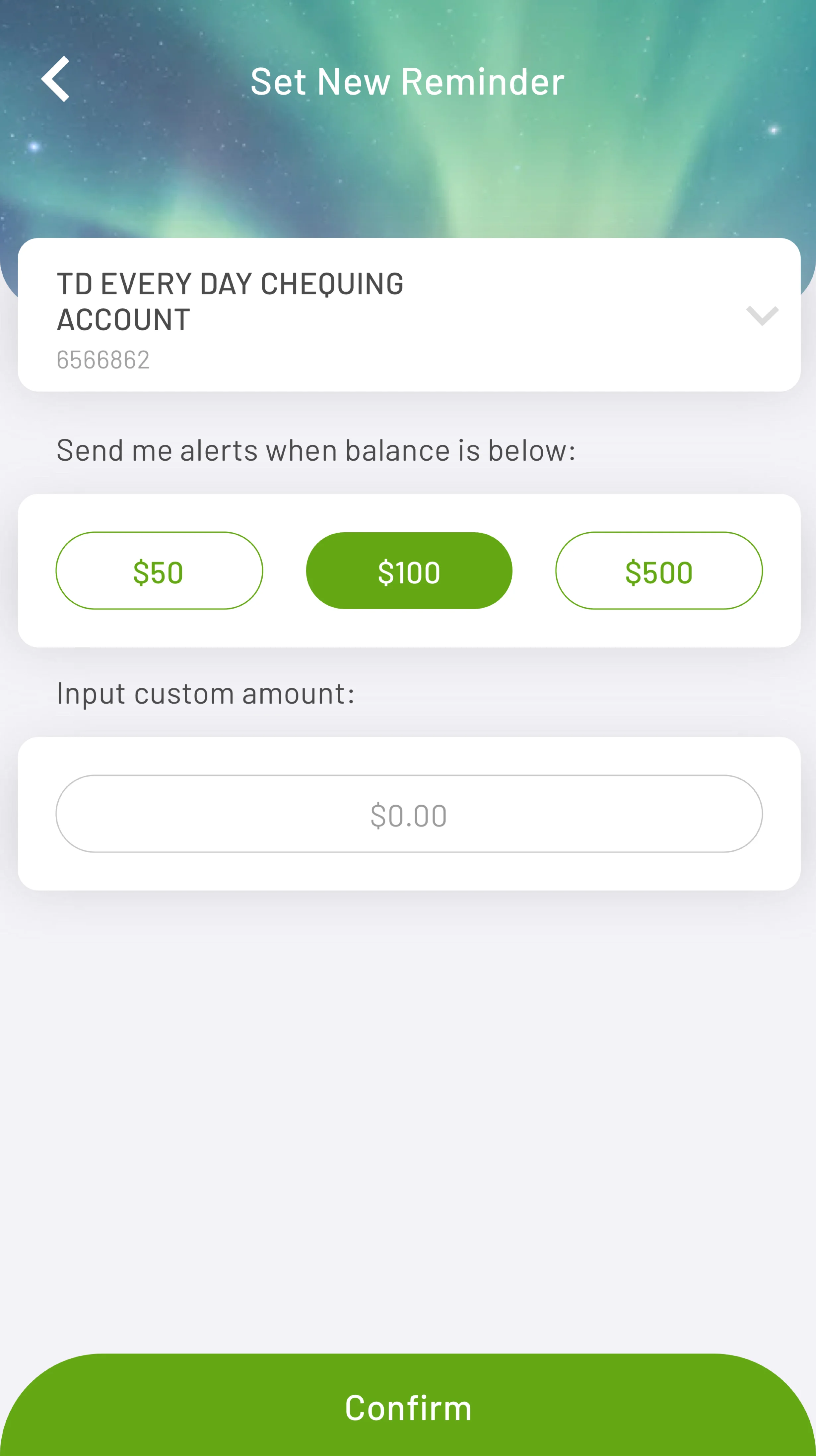

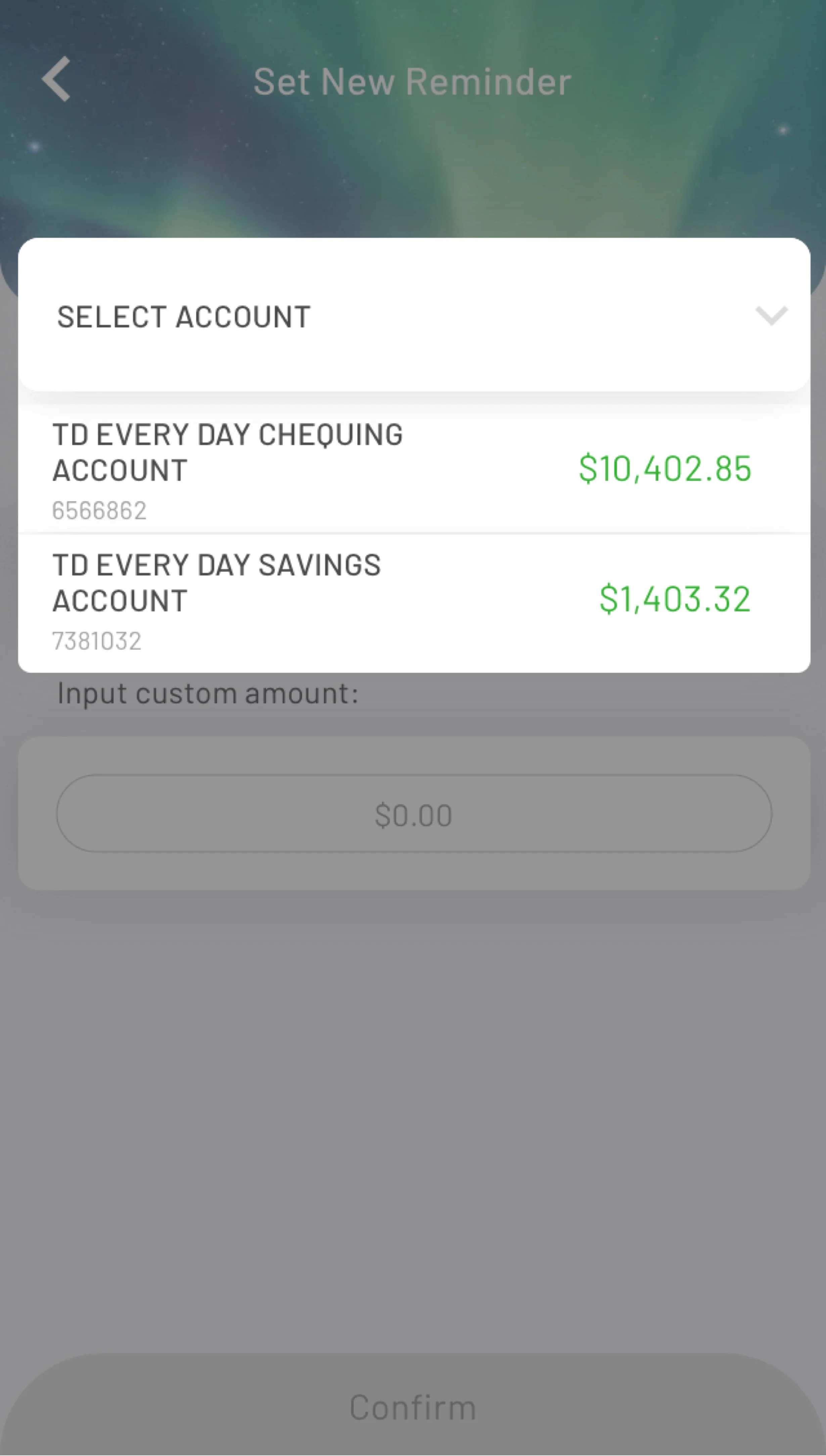

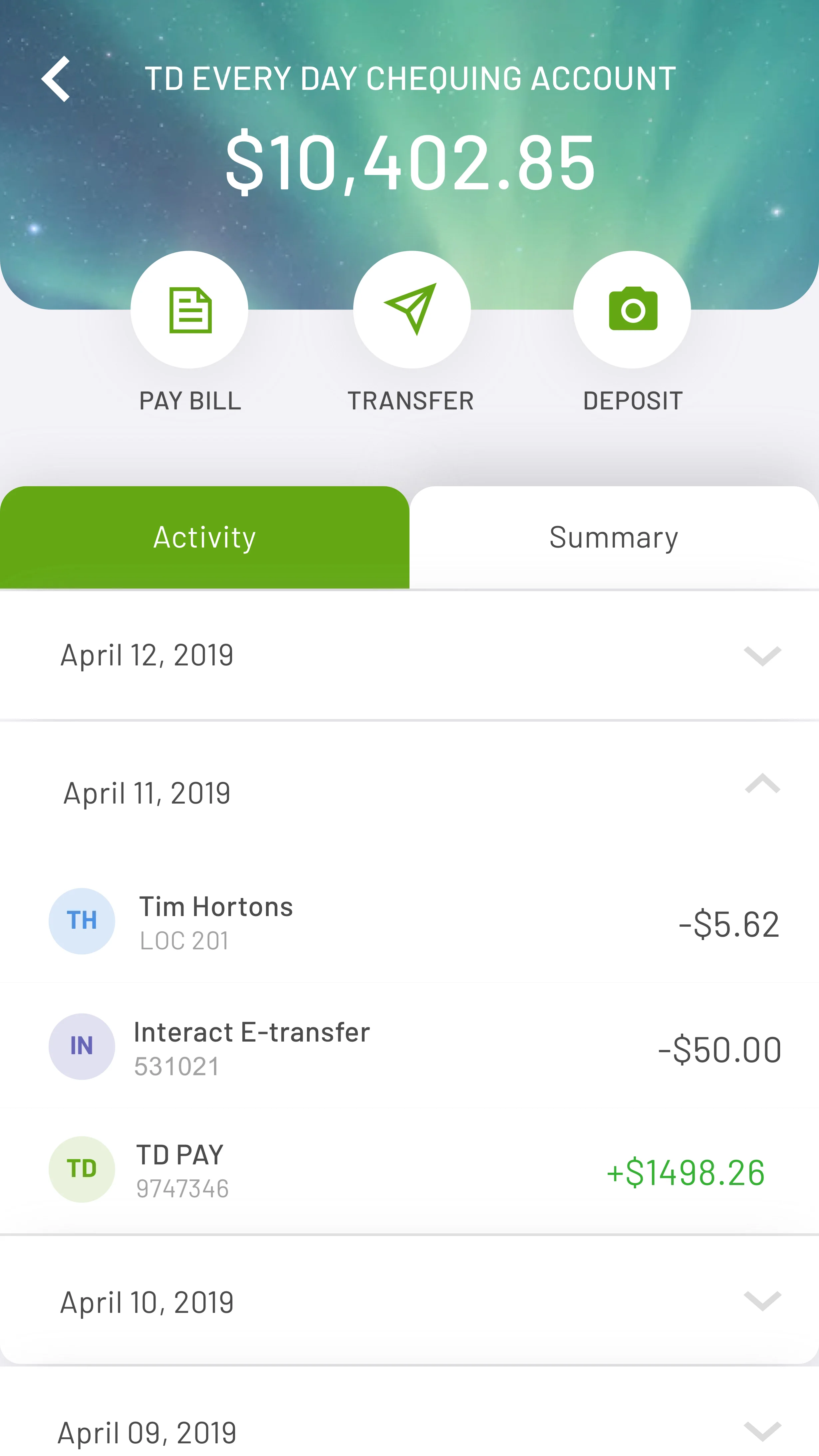

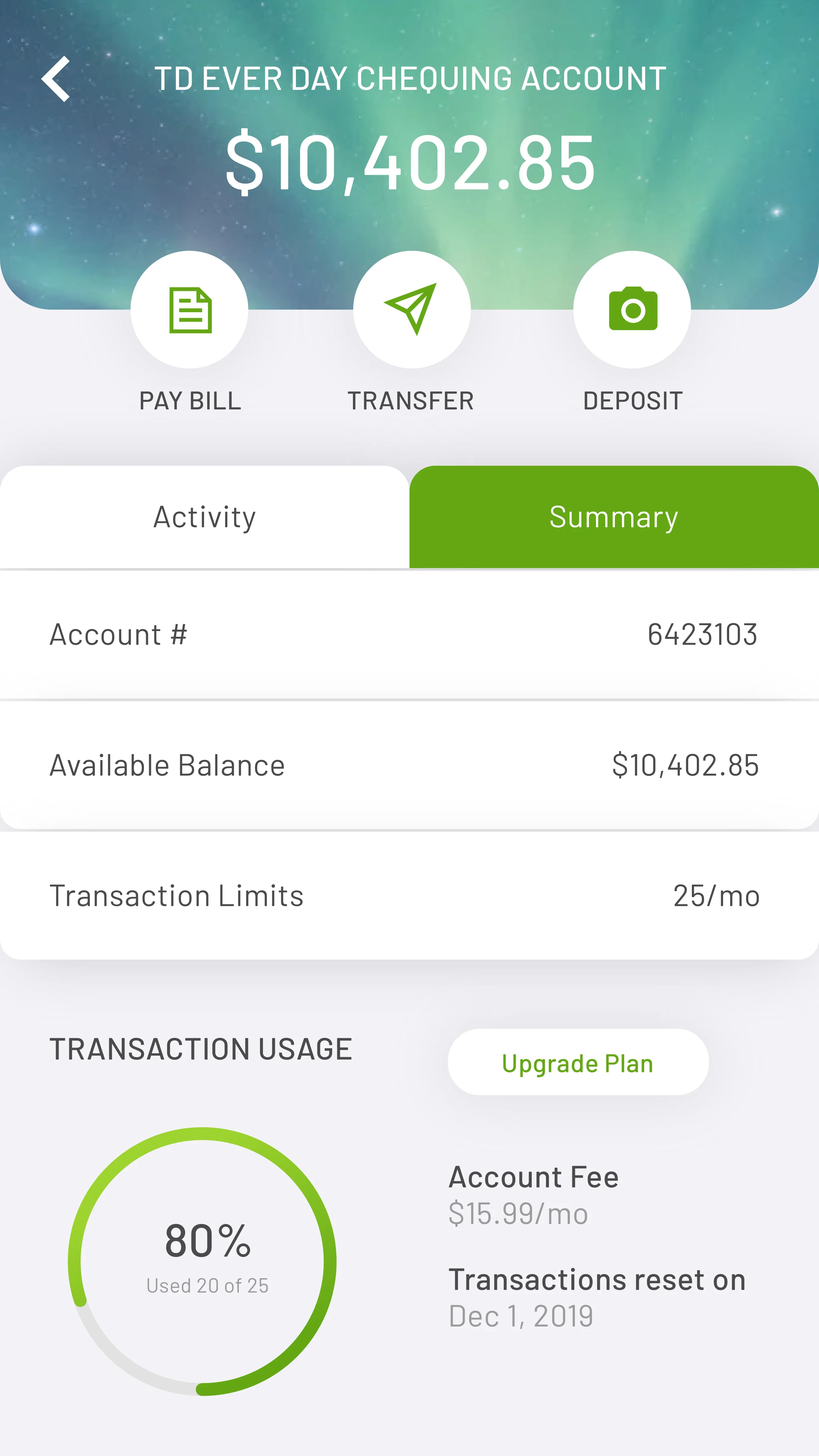

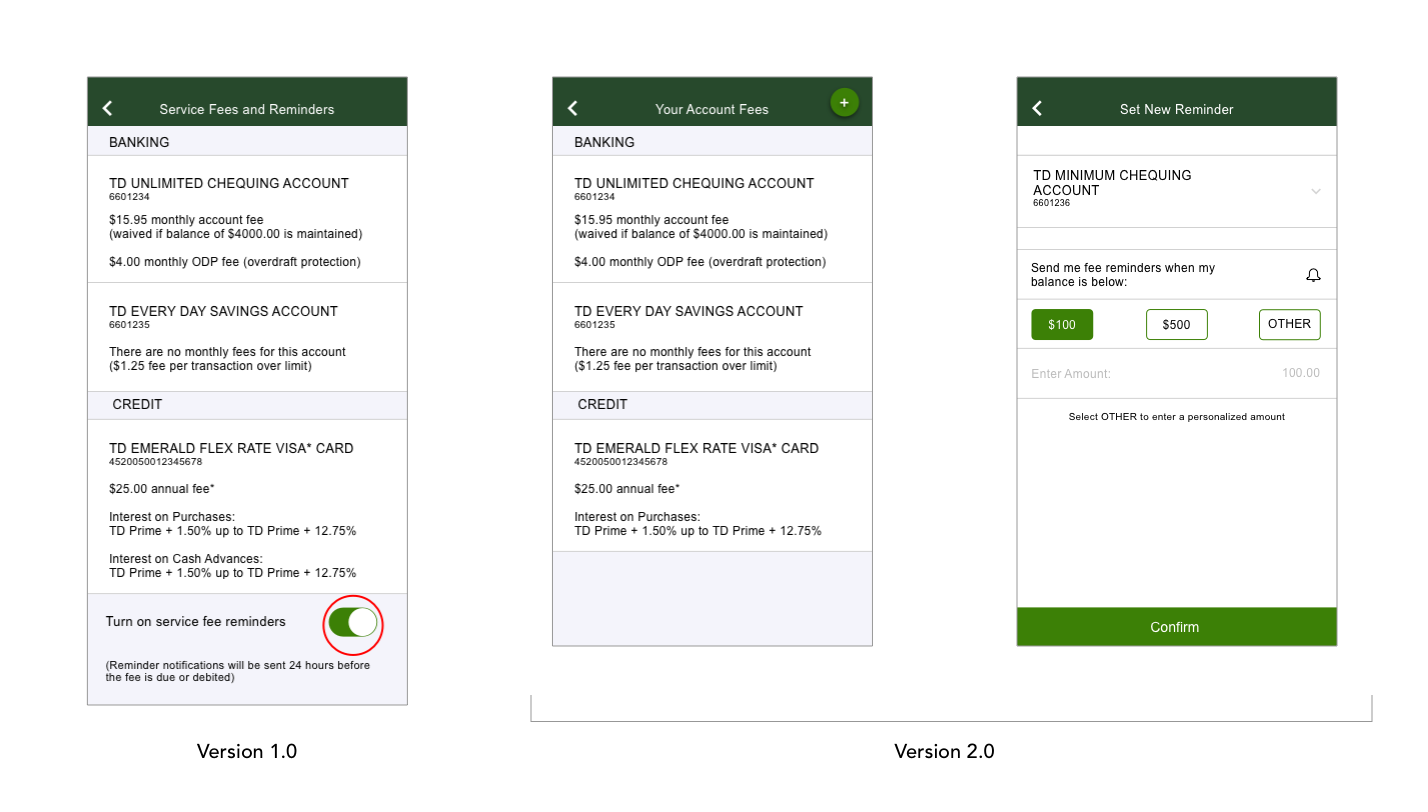

A Solution to Reduce Bank Fees,

Account Closures

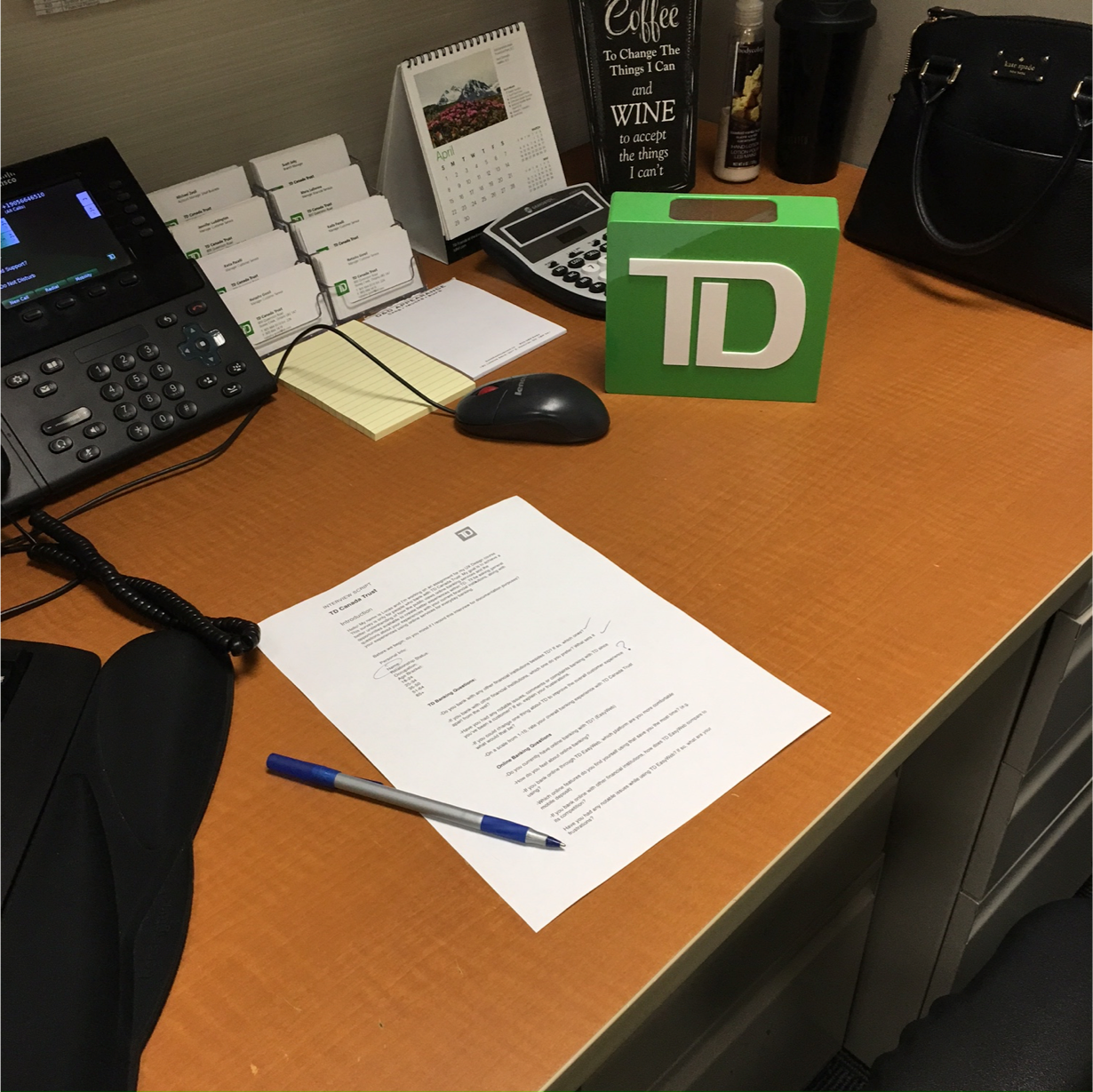

TD Bank refers to Toronto-Dominion Bank, a financial services group based in Canada. As a current customer & former employee, I made it my personal goal to improve TD’s mobile experience for its diverse group of users. From 2015 to 2018 employed as Customer Experience Associate, I inquired enough user information to begin my personal redesign project.